Through the use of algorithm-driven technology, we are able to obtain credit overview from various banks, increasing loan approvals up to 95%.

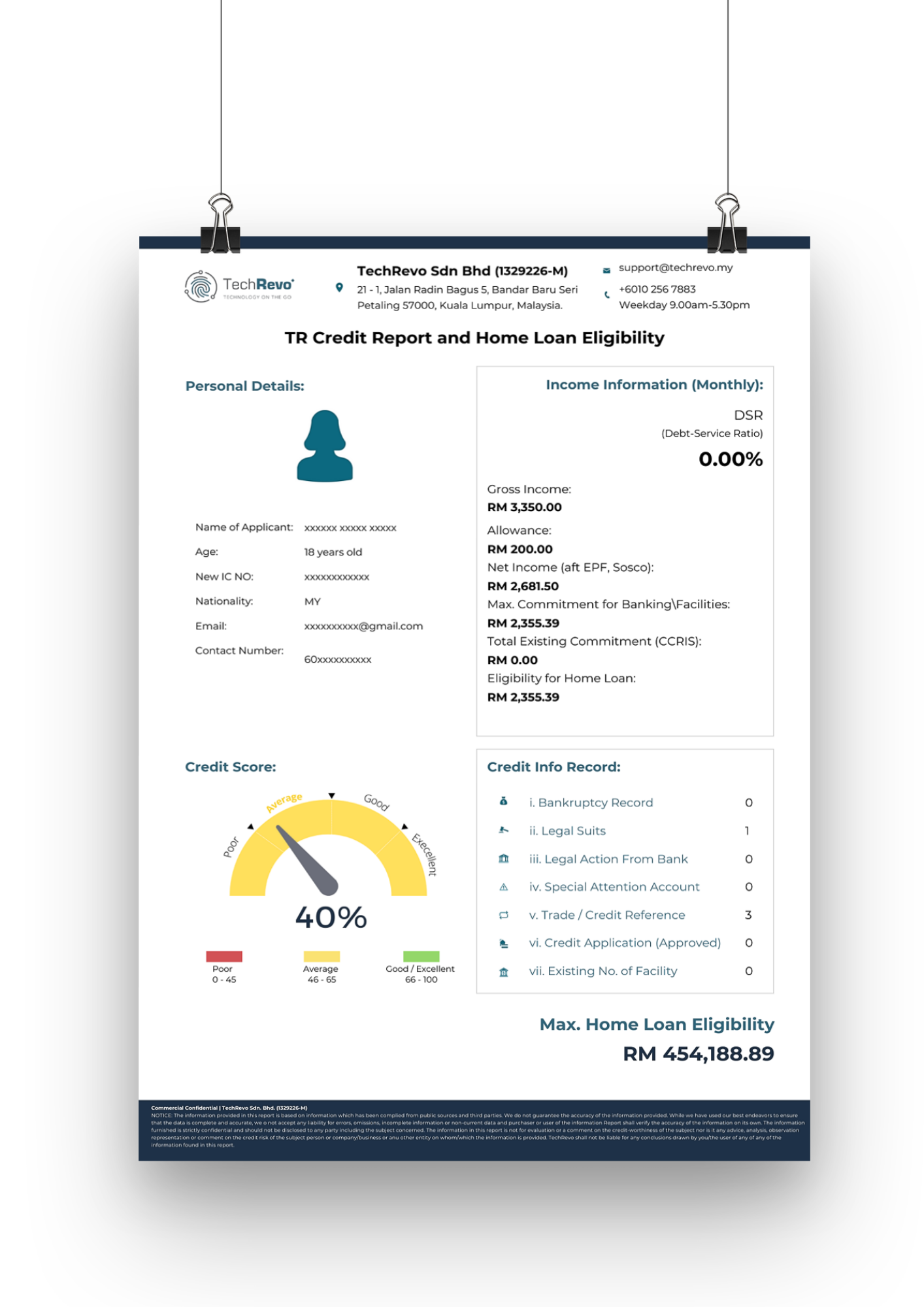

TechRevo captures a full record of your current and past debts, including your payment history (past 12 months). It's important to show banks your ability to purchase a property.

This upfront credit overview helps you understand your CCRIS issues, whether you have any legal filed against you or blacklisted from any banks. At here, you can run your credit evaluation, get your home loan eligibility in only five minutes.

Get your TR comprehensive credit report in less than five minutes.

Sign up - Sign up with email verifications at techrevo.com.my

Follow steps to purchase your TR credit report. Read your credit information carefully and if you are in any late repayments do fix it with your bankers.

Are you in any trouble in (late payment records, legal issues that’s against you, bankruptcy, AKPK, and etc)? If yes, please make settlement before entering a home loan application to avoid home loan rejection.

How much you have used up your income into commitment? Find out your DSR from us. Tips: the lower the better!

How much you can borrow and what is your maximum tenure? We have total 12 banks home loan eligibilities for you! Make your decision.

If your credit report is healthy find your local agent and banker to proceed your home loan application.

With a credit score. A credit score is calculated based on your debt payment behavior. If you always paid your installments and credit card payment on time. You will easily gain a good score

This is where you can check your financial status, did you get into trouble with any legal suits. Do take note that if you have any outstanding legal issues, this could significantly affect your loan application as these issues might represent a red flag in the banks’ loan approval process.

How much is your Debt to service ratio (DSR). A DSR calculation is calculated based on your monthly net income divided by the total monthly commitments. Banks regularly refer to an applicant’s DSR to determine how much loan an applicant will be given. Worry not! Through our app, all the relevant calculations and areas of a loan application will be done according to what the banks look for.

Report will provide you with a selection of banks and also the ones that would give you the best rate!